Recently there happened to be an accidental discussion with one Mr. Joshi, a retired Engineer and an acquaintance of another friend of mine. The discussion was accidental because it was not pre-planned and Mr. Joshi was telling us how wisely he had invested in a house property in his younger days and how he sold it recently at a phenomenal price and after paying taxes, buying a brand new premium apartment as an alternate dwelling, he is still having a large amount of cash surplus left with him for investment. My friend was praising Joshi for his phenomenal forethought and wise sense of investment, when I intervened. I said you cannot become rich just by investing, but by earning a good income through your business, profession or salary income as the case may be. Investing is out of your surpluses for your financial goals such as having your own house, giving the best education to your children, planning for your and your spouse’s old age, and meeting unforeseen expenditure like health issues etc. It is a fallacy that one can invest to become rich. Mr. Joshi could invest in a good house property at a high price even at that far back in time because his income was good at that young age and on that account a bank also financed his purchase. Of course, Mr. Joshi could have used up his surpluses for consumption and a lavish wasteful lifestyle instead of buying a house property. To that extent it was a wise decision, but the fact remains that a good income was the base for his wise decision. Moreover, Mr. Joshi would not have dreamt of his property appreciating so much when he invested, as his goal was just to have a house of his own. What actually transpired is something else than what was intended. It turned out to be a happy ending. Therefore becoming rich is not a direct outcome of investment but an offshoot of a good income. Of course, neither my friend nor Joshi agreed with me!

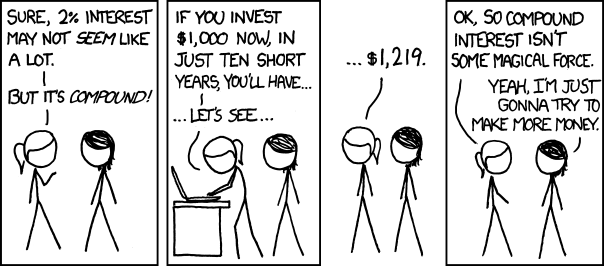

Having said that there is no gainsaying the fact that you need to invest and invest wisely to stay solvent and to meet your financial goals. For that you need a good income which generates large surpluses. But the financial goal can not be to become rich. To become rich by investing you need to speculate. That is a big risk, because leave alone becoming rich, it may erode your capital and make you insolvent! When you invest you get a return as per market dynamics. When you want to earn more than what market returns are, or beat the market, you are speculating. Speculation can give you phenomenal returns, but downside is losing your capital itself. Do not assume that you can replace your capital easily. Due to several reasons such as recession, you being laid off , no well paying replacement jobs around, your talents becoming redundant, sudden unforeseen bulk expenses etc. you may not be able to build up investible surpluses easily after losing your original capital. It may be a long drawn out uphill task to build replacement capital, and you would lose precious time. Time value of money will be the first casualty.

There are financial engineering products called derivatives such as futures and options in the stock market. These can be used for pure speculation or for hedging your position. Problem is, in adverse market conditions, these hedging instruments themselves can cause you losses! It is not that I am trying to scare you away, but bringing to your attention risks involved in investing vs speculation. You are taking resort to hedging instruments as insurance because you are speculating! Derivatives are not everybody’s cup of tea.

A friend of mine plans his surpluses out of his income in such a way that after allocating monies for essential investments to meet his financial goals, any surplus left is used for stock market speculation. He is a very disciplined speculator and has his own risk management approach to speculation. This is fine, because this way your core capital remains intact, and if you are lucky you can earn a little more return than the market. If you lose, it is no big deal as your core investments are intact and you are still able to meet your financial goals.

Do not make investment decisions purely based on what everybody else is doing. Take the example of bitcoin, silver and gold market. The values of these commodities shot up due to massive speculation by traders and not due to any fundamentals. Due to herd mentality even small investors either directly invested in physical commodities or futures. The big speculators were leveraged heavily in currency markets. When prices crashed and the bubble burst many people lost their capital and became bankrupt.

What is leveraging? It is using borrowed capital with an intention to invest at a rate of return higher than the borrowing cost and making a profit. This a high risk /high return strategy because many things can go wrong, such as lending rates going up and deposit rates going down etc. Or the expected return on investment falling short of borrowing cost. Never go for leveraged investments. I remember one of my friends borrowing from provident fund to invest in a booming stock market to make a killing. When market crashed, he was left with PF loan liability as he lost his borrowed capital invested in the market.

Do not invest only with the intention of beating the taxman. Tax incentive investments make no sense when they give you marginal benefits, have a long lock in period, and return is lower than alternative investment avenues. Take for example, an investment in tax saving deposit with a bank when you are in the lowest tax slab. Your taxable income can be reduced up to Rs 1.5 lakhs giving a tax benefit of Rs 15000 for that financial year. But the deposit may fetch you say 8-8.5% PA less TDS of 10%, and have a lock in of 5 years. Tax benefits should be incidental to investments and not the raison d’etre for investments.

Many professional investment advisers are out there including relationship managers of your bank. They make a living out of salaries and incentives based on what product they sell to you to meet their internal targets. They may never invest their own money in products which they recommend to you. So, their advice may not be always fair and above board. Listen to their pitch, ask questions but take your own decision. Do not blindly follow advice. You might have heard the story of a RM selling a whole life policy to a 50 year old widow with no children, and subsisting on a family pension because the RM had a target for the product! The widow had implicit faith in the RM and knew nothing about the product or its suitability for a person in her position.

Manage your investments the same way you manage your profession, employment or your business and personal life. Always hold some cash or cash equivalent for unforeseen and urgent requirement. The rules of safe and productive investing are little different from the rules of life: recognize that you live in an uncertain world, don’t expect the impossible, and don’t trust strangers. Do not put all your eggs in one basket, diversify your portfolio. Do not invest in products which you do not understand just because somebody made good money out of it. If you apply to your investments the same realistic and common sense attitude that produced your present wealth, you needn’t fear that you’ll ever go broke.

Lastly do not be a Shylock. Enjoy life within your means after taking care of your financial goals. Rich is a relative term. If you cannot enjoy your wealth, then what is it for?