You just got your annual bonus. You want to decide between whether to use the bonus to prepay the home loan. Or put this money away in a bank fixed deposit or any other investment. The approach is simple.

If the post-tax cost of your loan is HIGHER than the post-tax return from the supposed investment, you prepay the loan. Or else you make the investment.

In this post, let us limit the choice of investments to bank fixed deposits and debt mutual funds. I limit this choice because the interest rates have moved down sharply (for both loans and FDs) over the past 18-24 months. Hence, the decision you make today can be far different from the decision you would have made one year ago.

Bank Fixed Deposits

With bank fixed deposits, the choice is easy. If you can open a bank fixed deposit at 4.5% p.a. while your home loan costs 8% p.a., the case for using this money to part prepay the loan becomes much stronger. Alternatively, if your bank FD is getting renewed bank FD at 4.5% p.a. while the home loan costs much more, you must think again.

The assumption here is that you don’t need this money for any other purpose. And you must make a choice only between investing this money or prepaying the home loan.

You need to exercise some discretion too. Not all FDs are similar. For instance, you may have put your emergency buffer in a bank fixed deposit. Now, you shouldn’t draw from your emergency fund to prepay your home loan. It does not matter what the FD renewal rate is.

Debt Mutual Funds

Many of us put money into debt mutual funds for tax efficiency. While debt funds are indeed tax-efficient, especially for investments in the higher tax brackets, there is no guarantee of returns. Unlike bank fixed deposits where you know the returns (interest rate) upfront, there is no such comfort with debt funds.

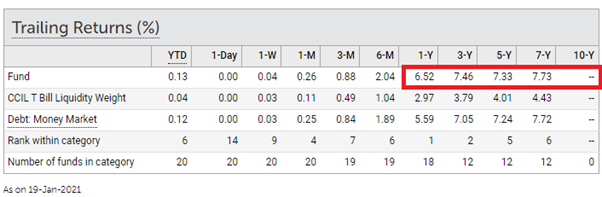

How do you get a sense of debt MF returns? Many of us just look at the past returns to get a sense of the expected returns. For instance, you could just look at the past 1-year return from the fund scheme and simply extrapolate that this performance will continue. And to look at the past performance, you go to ValueResearch website and look at the performance of a debt mutual fund. I copy the data for a money market fund.

So, you would look at the above data and guess that you would get about 6-7% p.a. from your investment going forward. Now, this can be misleading, especially during times when the interest rates are going down or have gone down. Why? Let’s first look at how debt mutual funds work.

Debt mutual funds invest in bonds issued by the Government, PSU, or corporates. Hence, your returns from investing in a debt fund will depend on the income from those bonds. If bonds are offering higher interest (or yields), your returns will be higher. Alternatively, if the bonds are offering low interest rates (or yields), your returns will be lower.

There is an additional dynamic. The bonds prices are inversely linked to interest rates. When the interest rates rise, the bond prices fall. When the interest rates fall, the bond prices rise. And if the bond prices rise, the NAV of the debt mutual fund will also rise. That is positive news. However, there is a flip side too. If a Rs 100 bond gives Rs 8 as interest per annum, your return is 8% p.a. However, if the interest rates fall and you buy the same bond at Rs 110, your return is 7.2% per annum. Moreover, going forward, the cash inflows into the fund or the reinvestment of the interest received will be done at lower interest rates. This will bring down your future returns unless the interest rates continue to fall further.

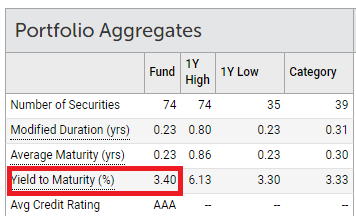

This sounds complicated. Give me something simple, you may say. Well, we are trying to guess the expected returns from a debt mutual fund scheme, so that we can decide whether to put the money into the debt fund or use the money to prepay the loan. For this, you need to look at Yield-to-maturity (YTM). YTM is the best indicator of what to expect from your debt mutual funds in terms of returns. You can get YTM for any debt scheme on ValueResearch. For instance, I copy the YTM of the same money market fund (as shown above).

The YTM is 3.4% p.a. The past 1-year return is 6.52% p.a. I would trust YTM more. By the way, some part of this 6.52% (past 1 year return) could also be due to interest rates moving down. You can see 1-year High YTM is 6.13. Now, it is 3.4% p.a. Thus, this drop is YTMs has also given fillip to fund returns.

And yes, the YTM won’t always be lower than past 1-year returns. During times when interest rates are going up, the situation might be completely reverse. Note that YTM keeps changing too. YTM will depend on change in the yield curve. Hence, you can never be completely sure about the returns, but this gives you an idea (especially for short duration funds).

For your estimate of returns in the near term you can simply deduct expense ratio from the YTM. So, if the scheme expense ratio is 0.25%, you can expect around 3.15% (3.4-0.25) from this scheme in the near future. Your returns will also depend on how interest rates move after your investment.

Again, there are two dynamics at play.

- If the interest rates (YTM) go down, the bond prices will increase (Good) but the incremental money will be invested at lower rates (not so good).

- If the interest rates (YTM) move up, the bond prices will fall (bad) but the incremental money will be invested at higher rates (Good).

Thus, YTM is only an indicator. Your return experience may be different from the YTM at the time of your investment. However, it is still a much better indicator than past 1-year returns.

What Should You Do — Prepay Your Loan OR Invest in Debt Fund?

If I had to choose between investing in a debt fund with YTM of 3.4% and prepaying a home loan at 8% p.a., I would prepay the loan. In this case (and current interest rate regime), even with tax benefits of home loan, the post-tax cost of home loan is likely to be higher than post-tax returns from the investment.

Please understand YTM may change. Home loan interest rate may change. When the facts change, the opinion can change too. Note I have assumed no prepayment penalty. Home loans usually have no prepayment penalty, but you may have a prepayment penalty in case of personal loans. Such a penalty can complicate matters.

Other Investment Options

Additionally, your investment choice may not be limited to bank FDs or debt funds. PPF still offers 7.1% p.a. You will likely get an even higher return in EPF/VPF. At current rates, between putting money in PPF and prepay home loan, I will choose investing in PPF.